What a real decentralized cryptocurrency is has become a bit blurred today. Bitcoin, with its proof-of-work blockchain, was conceived and intended to be fully decentralized. It was designed to run with a collective of participants using majority rule. Many crypto investors think that all cryptocurrencies are decentralized. However, this is not the case. This article shares how to determine if a coin is really decentralized or not – and how many coins fall somewhere in between.

Crypto culture has become increasingly tribalistic over the last several years. Fans of one crypto often take to social media to argue with rival token holders. A common insult used during these debates is to say another crypto is centralized.

A repeated misconception among crypto investors is that blockchains are decentralized by default. But what is decentralization, and how do crypto investors determine if a coin is or isn’t decentralized?

Quick facts:

- The decentralization of blockchain platforms is a spectrum, with some more decentralized than others.

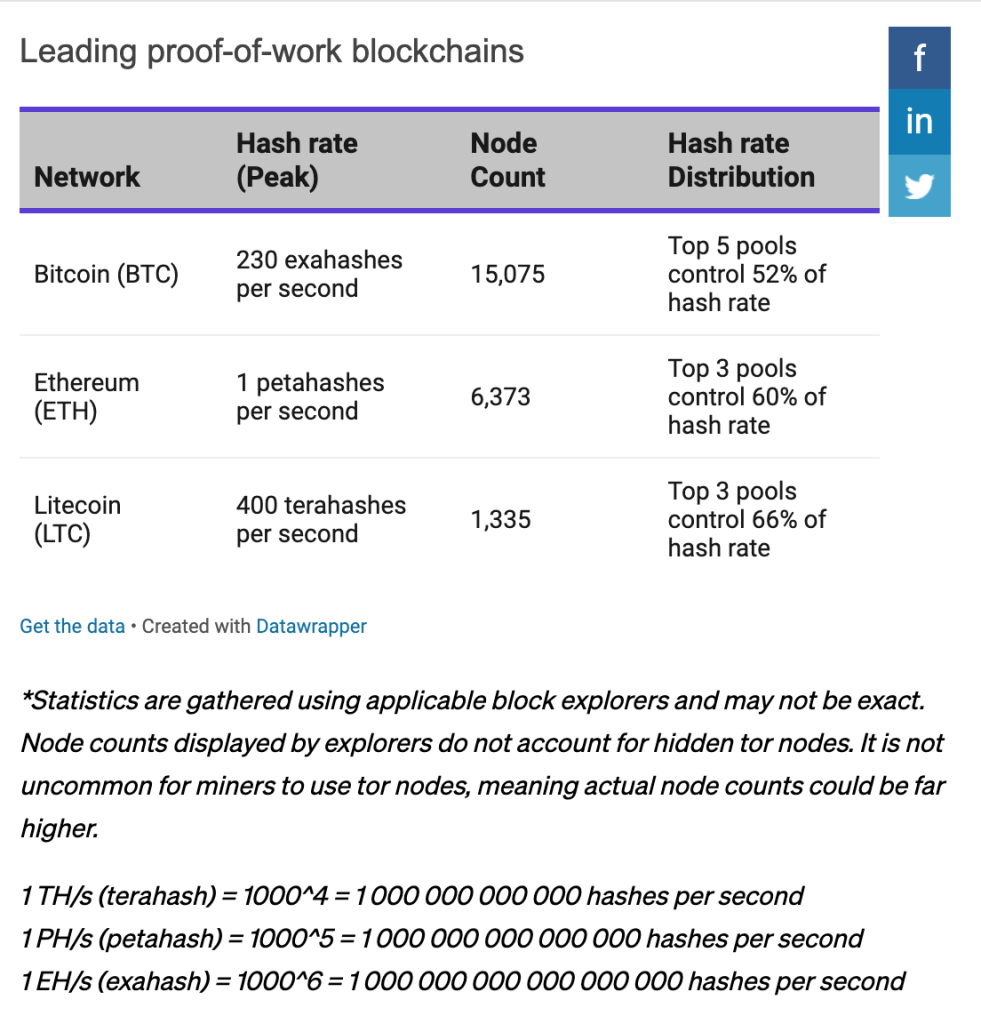

- The decentralization of proof-of-work blockchains can be measured by the size of their cumulative hash rate and the number of entities it is divided amongst.

- The decentralization of proof-of-stake blockchains can be measured by the percentage of a coins circulating supply that is staked to the network and how many entities that stake is divided amongst.

- Other factors, such as governance and development control, network accessibility and figurehead influence, should be considered when determining the decentralization of a blockchain platform.

What is decentralization?

A good or service is decentralized if it is run by a collective of participants using majority rule. In the case of bitcoin, its attributes, such as the total supply of bitcoins, are determined by the majority of its network participants.

Understanding decentralization and its importance is imperative to understanding cryptocurrency in general and why it was created in the first place.

Why is decentralization important?

Centralized systems, or systems where one entity has full control, often fall victim to conflicts of interest. These systems also have one single point of failure, making them more susceptible to attacks.

Decentralized systems have no single point of failure and cannot enact changes unless the majority of participating parties agree, significantly decreasing the likelihood of a successful attack and the possibility of corruption.

Related: https://fluxhighway.com/no-jack-dorsey-venture-capital-will-not-run-web3/

Outside of the internet, which is partially centralized due to internet service providers, bitcoin is the first real example of a system with no central authority.

Manipulation of money and inequality

Bitcoin was born out of the 2008 financial crisis, a time when banks were bailed out and the Federal Reserve used quantitative easing to slow the recession.

Bitcoiners believed the Fed’s strategy was entirely unfair to citizens who had no say whether banks should be given taxpayer money for failed investments. They also questioned whether one entity, the Fed, should have the autonomy to expand or contract the money supply.

Inflation from quantitative easing has drastically lowered the purchasing power of the dollar over time, damaging those living from paycheck to paycheck with stagnant wages. This contributes to inequality, as those who can afford to invest in other assets can compound wealth while those who cannot continue to lose purchasing power.

Bitcoiners also feel the existing monetary systems of the world significantly increase the disenfranchisement of certain populations, particularly those in countries where access to financial products is uncommon or nonexistent.

These products typically require two or more forms of government-issued identification, verifiable addresses, credit and other conditions to which many people do not have access. As a result, they often have no alternative to cash-based economies where theft and violence are prominent.

While some argue that cryptocurrency allows criminals to slip by more easily, others say it can increase financial inclusivity, resulting in a net positive, regardless of criminal activity.

“Centralized shitcoin,” the ultimate crypto diss

The idea behind bitcoin was to create a global monetary network, run by and for the people, with no restrictions. Many crypto investors claim that cryptocurrencies with little decentralization are more akin to a random currency minted by a company, and that cryptos that forego decentralization are completely missing the initial point.

For that reason, crypto enthusiasts often prize decentralization and shame coins that show signs of centralization.

Measuring decentralization

The decentralization of a crypto network can be hard to measure, especially when comparing networks with different designs. Fortunately, blockchains share enough traits to assess a network’s decentralization, but investors should understand that decentralization is a spectrum, and most popular blockchains are not entirely centralized or decentralized.

Related: https://fluxhighway.com/next-generation-internet-explained-learn-web3-basics-2022/

Measuring the decentralization of the two types of blockchains — proof-of-work and proof-of-stake — involves different factors.

Proof-of-work

Proof-of-work blockchains, such as Bitcoin, are made up of users and nodes — both non-mining and mining. The decentralization and security of these networks are largely dependent on how high their hash rate is and how many entities the hash rate is distributed among. The hash rate of a proof-of-work blockchain represents the cumulative processing power miners provide the network. The higher the hash rate, the harder it is to disrupt.

Anyone can set up mining pools on proof-of-work blockchains, and anyone can add hash rate to a pool. This means that the hash rate in pools can be redistributed to other pools at any moment. Still, a higher distribution of hash rate among a larger number of pools is preferred for decentralization.

Proof-of-stake

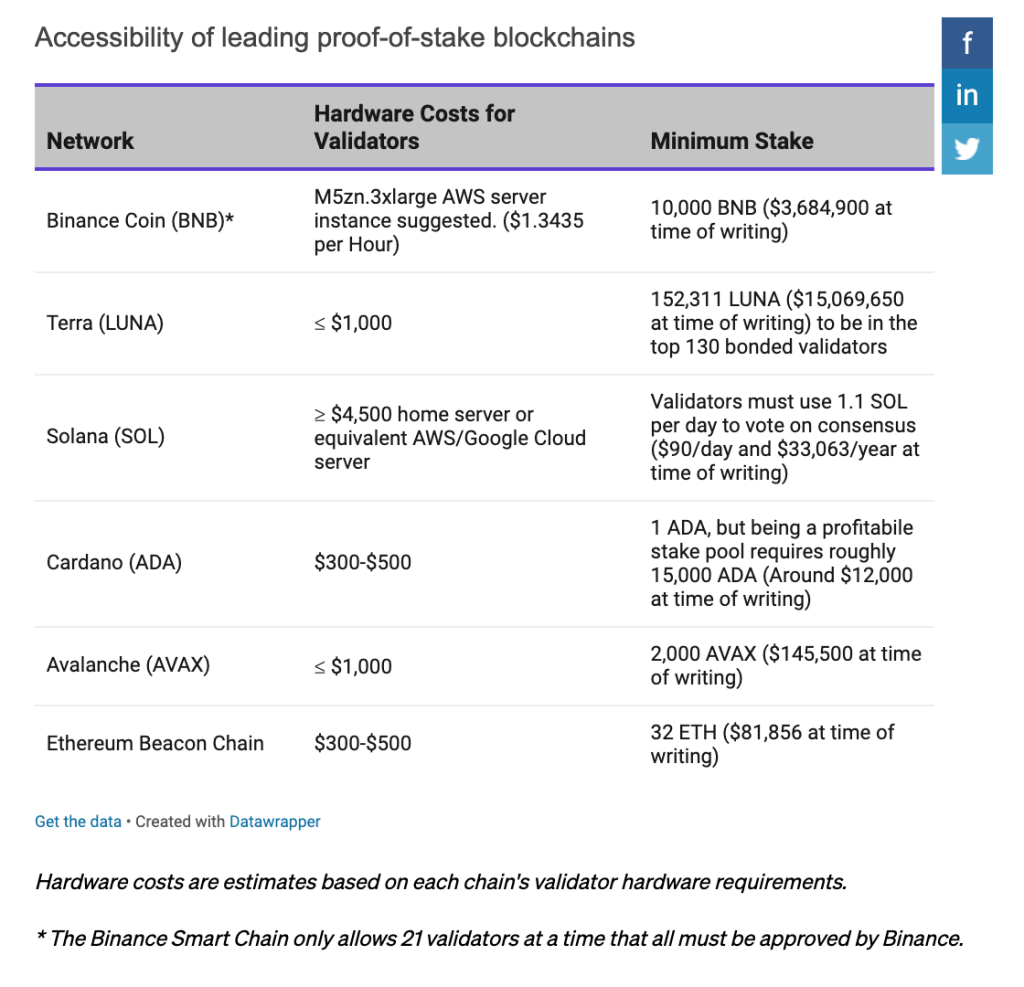

Decentralization of a proof-of-stake blockchain can be measured by the count of stake pools or validators, distribution of the token supply across those validators, and the percentage of token supply that is staked. The higher the percentage of the token supply that is staked, the harder it is to disrupt the network.

Also consider the initial distribution of proof-of-stake tokens in private sales. Proof-of-stake blockchains determine who can add blocks to the chain based on the number of tokens they hold. The sale of tokens to venture capital firms or other inside investors before the public can purchase them can create unfair advantages for these early investors.

Distribution of token supply across validators

The spread of the stake across validators can also give insight into a coin’s degree of decentralization.

Binance Coin (BNB): All staked BNB is delegated to the 21 approved validators on the Binance Smart Chain.

Terra (LUNA): All staked LUNA is delegated to the 130 bonded validators on the Terra network.

Solana (SOL): The top 19 validators on Solana’s network control just under 34% of the total stake on the network. Solana’s consensus model requires a supermajority, or greater than 66% of the stake, to reach consensus.

If 33% of the stake colluded and decided to go offline, they can effectively perform a denial of service attack and shut down the network. While this does not necessarily result in false or lost transactions, it can cause intermittent downtime, which Solana has fallen victim to in the past.

Cardano (ADA): Over 2,200 individual single-pool operators hold 22% of the total stake. One vector of centralization is Binance, which runs 62 pools and holds just under 12.4% of the total stake. The rest is made up of entities running 2 or more stake pools with 3.14% of the total stake or less.

Avalanche (AVAX): 50 nodes control 50% of the staked AVAX.

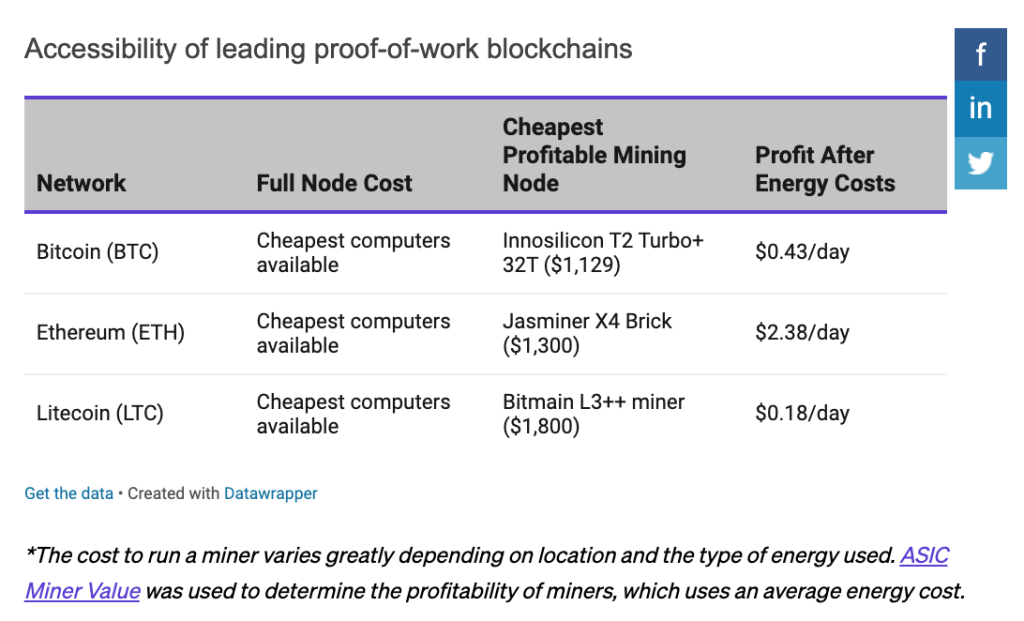

Accessibility

Bitcoin’s initial design was to be open and accessible to anyone. Early bitcoin nodes were run on basic home computers and did not require specialized hardware to mine. This changed when early bitcoin user Laszlo Hanyecz managed to mine bitcoin using a GPU (graphics processing unit), a processor more powerful than typical computer chips.

From that point on, bitcoin mining became a highly competitive market where miners rushed to buy the fastest GPUs to win as many blocks as possible. Eventually, companies formed to develop new chips dedicated to bitcoin mining.

While this bolstered the network’s security by increasing the cumulative hash rate, it lowered network accessibility. Only those with deeper pockets could participate in its infrastructure.

Governance and development distribution

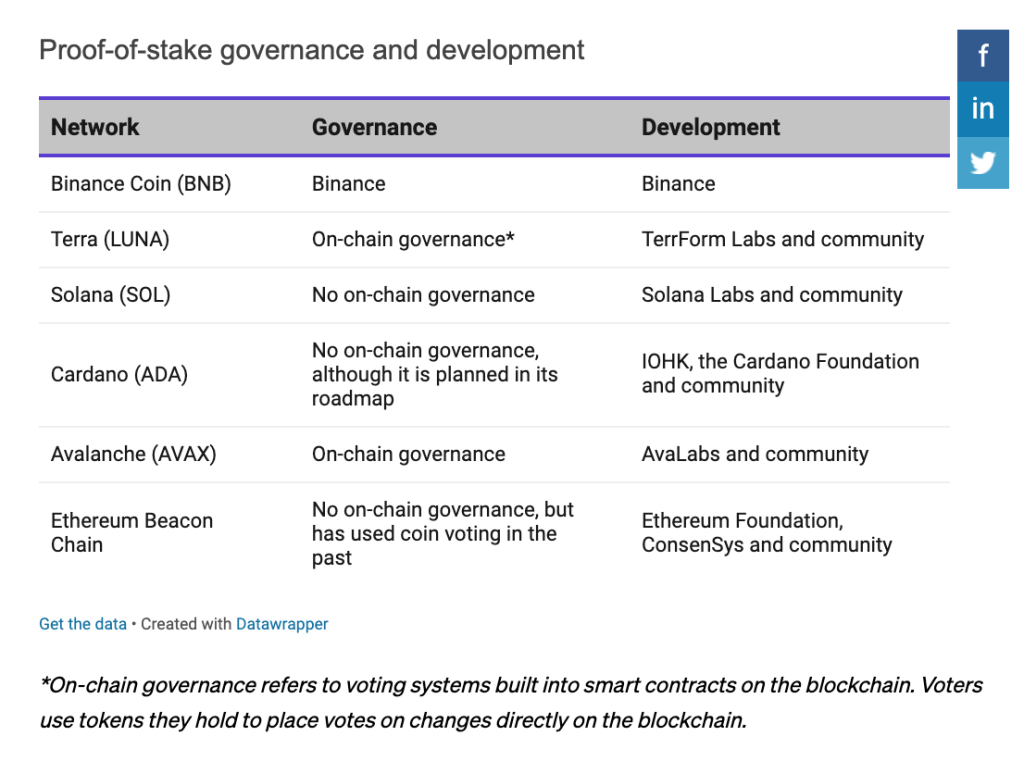

Investors seeking more decentralized projects should consider how a blockchain’s governance operates and whether development is controlled by a centralized organization or the community.

Some newer blockchains still rely on centralized development teams to make updates and may decentralize this process over time. Others, like Bitcoin, have broader development communities where proposals for change can be made by anyone.

Proof-of-work governance and development

Development for leading proof-of-work blockchains is mostly community-driven. Community members can submit improvement proposals that the community will then debate and implement if agreed upon. Should a majority of node operators agree that the proposal is the right step forward, then they will update their nodes with the new code that reflects the improvements.

There are nonprofit foundations, such as the Ethereum Foundation and Litecoin Foundation, that help support the development of these platforms. While these foundations can deploy money in certain areas, they do not dictate the direction of these platforms.

Proof-of-stake governance and development

Proof-of-stake blockchain governance and development are largely driven by founding teams. This is a centralization concern, but many of these networks are still in their infancy and require some sort of guidance to achieve technological goals.

Validator count and distribution become more important when founding teams still have a large influence on upgrades. Should a founding entity want to enact a new change, the validators of the network still need to accept and download the changes for them to actually be implemented across the network.

If there are very few validators and if the founding entity controls a large percentage of them, then that founding entity can unilaterally deploy changes at will. The more validators there are and the more they are spread among different entities, the more democratic protocol changes become.

Private sales can also have an effect on governance. If a large percentage of the token supply was sold to select insiders, they can have a large influence on governance and the general direction of a blockchain platform.

Other Considerations

The world of crypto is messy and confusing. For this reason, some investors have only a basic understanding of their investments, allowing some coin founders to become more influential to a decentralized protocol than they should be. Even early bitcoin investors give Satoshi Nakamoto a deity-like status even though the pseudonymous person has no control over bitcoin’s direction.

While there is likely no reason for a figurehead to act in anything but the best interest of an ecosystem they helped to create, investors should still be wary of their influence.

Examples of this in today’s crypto market include Vitalik Buterin of Ethereum, Charles Hoskinson of Cardano, Gavin Wood of Polkadot and Anatoly Yakavenko of Solana.

Frequently asked questions:

What is decentralization?

A good or service is decentralized if it is run by a collective of participants using majority rule. In the case of bitcoin, its attributes, such as the total supply of bitcoins, are determined by the majority of its network participants.

How do you measure decentralization?

Proof-of-work

The decentralization of a proof-of-work blockchain is measured by the size of its hash rate, how distributed the hash rate is among different entities and how community-driven updates to the protocol are.

Proof-of-stake

Decentralization of a proof-of-stake blockchain is measured by the count of stake pools or validators, distribution of the token supply across those validators, and the percentage of token supply that is staked. The level of democracy in a proof-of-stake blockchain’s development and governance is another important consideration.

Although the material contained in this website was prepared based on information from public and private sources that Fluxhighway.com believes to be reliable, no representation, warranty or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and Fluxhighway.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.

Via this https://blockworks.co/measuring-decentralization-is-your-crypto-decentralized/